Mark Cuban speaks onstage during the 2025 SXSW Conference and Festival at Hilton Austin on March 10, 2025 in Austin, Texas.

Julia Beverly | Wireimage | Getty Images

Mark Cuban is launching a new $750 million private equity fund focused on sports franchises, called Harbinger Sports Partners.

As sports valuations soar and teams look for new capital, the professional leagues have increasingly opened the door to private equity investment. In August, NFL owners became the last major sports league to approve private equity investment, allowing up to a 10% stake by select firms.

HSP says it will focus its investments on acquiring minority stakes in pro sports franchises across all U.S. leagues, adding it will deploy a data-driven approach to identifying undervalued sports assets. It will look to acquire positions of between 1% and 5% in 92 franchises. Deal sizes could range from $50 million to $150 million, the founders said in a statement.

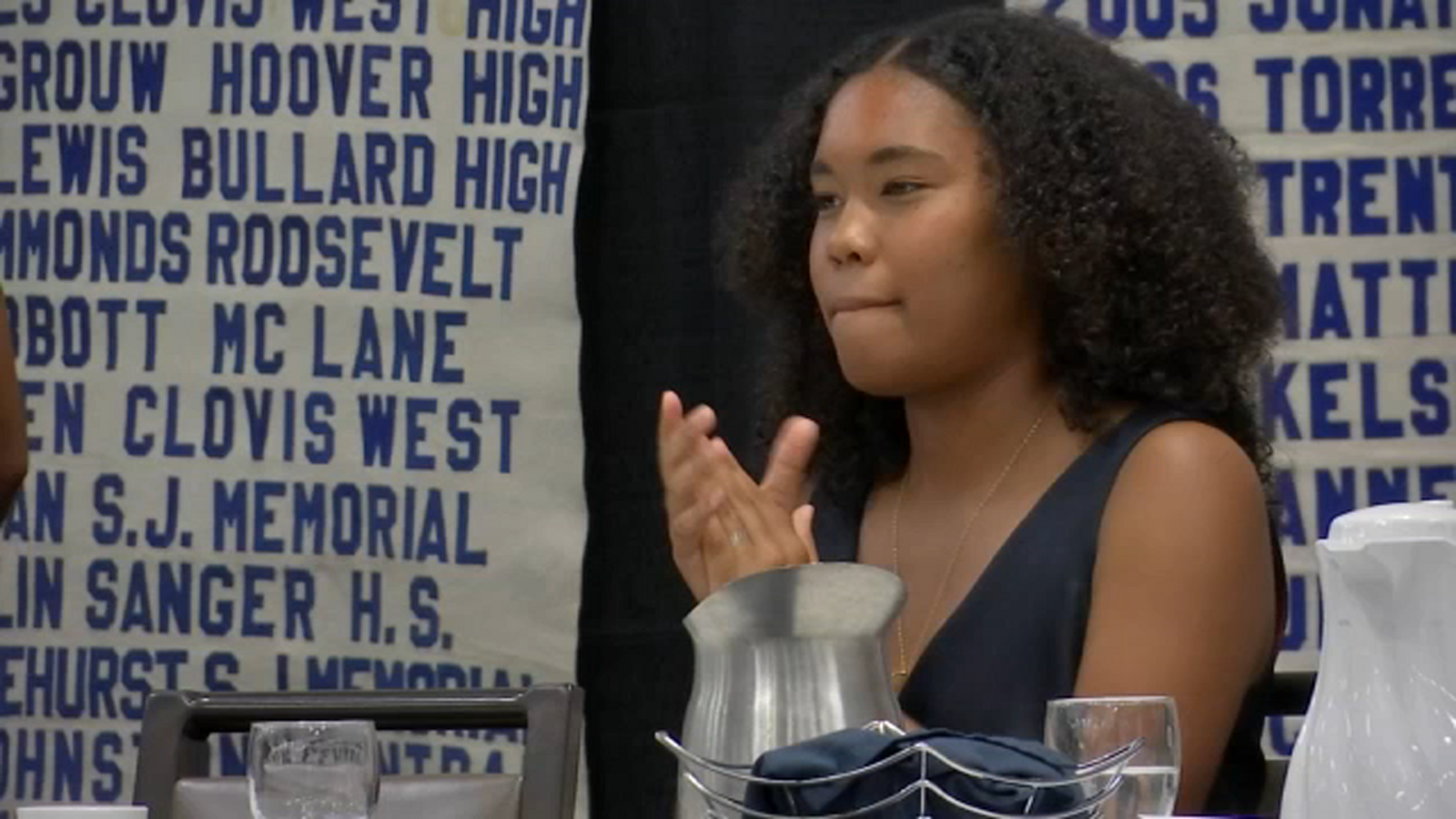

Steve Cannon, Rashaun Williams and Mark Cuban launch Harbinger Sports Partners, a $750 million fund that will focus on minority stakes in U.S. sports franchises

Harbinger Sports Partners

Joining Cuban as founding partners is two veteran sports executives, Rashaun Williams, who is a limited partner in the Atlanta Falcons, and Steve Cannon, former CEO of Atlanta Falcons parent company AMB Sports and Entertainment.

"The professional sports sector is maturing into an institutional-quality asset class," Williams said in a statement. "Harbinger will be structured to operate within league frameworks while offering long-term capital, operational fluency, and a responsible ownership mindset."

Cuban sold his majority stake in the NBA's Dallas Mavericks in December 2023 to Miriam Adelson and her family but still holds a 27% minority stake in the team.

Harbinger says in addition to sourcing and underwriting deals, it will help with liquidity planning for its portfolio teams.

English (US) ·

English (US) ·