Theo Leggett

International Business Correspondent

BBC

BBC

In China, they call it the Seagull, and it has looks to match. It is sleek and angular, with bright, downward-slanting headlights that have more than a hint of mischievous eyes about them.

It is, of course, a car. A very small one, designed as a cheap city runabout – but it could have huge significance. Available in China since 2023, where it has proved extremely popular, it has just been launched in Europe with the name Dolphin Surf (because Europeans apparently aren't as keen on seagulls as Chinese people).

When it goes on sale in the UK this week, it's expected to have a price tag of around £18,000. That will still make it, for an electric car on western markets, very cheap indeed.

It won't be the outright lowest-priced model on offer: the Dacia Spring, manufactured in Wuhan jointly by Renault and Dongfeng, and the Leapmotor T03, which is being produced by a joint venture between Chinese startup Leapmotor and Stellantis, both cost less.

But the Dolphin Surf is the invasive species that has long-established brands most worried. That is because the company behind it has been making ever bigger waves on international markets.

Bloomberg via Getty

Bloomberg via Getty

The BYD Dolphin Surf will be priced at around £18,000 in the UK - ultra cheap for an EV

BYD is already the biggest player in China. It overtook Tesla in 2024 to become the world's best-selling maker of electric vehicles (EVs), and since entering the European markets two years ago, it has expanded aggressively.

"We want to be number one in the British market within 10 years," says Steve Beattie, sales and marketing director for BYD UK.

BYD is part of a wider expansion of Chinese companies and brands that some believe could change the face of the global motor industry – and which has already prompted radical action from the US government and the EU.

It means once-unknown marques like Nio, Xpeng, Zeekr or Omoda could become every bit as much household names as Ford or Volkswagen. They will join classic brands such as MG, Volvo and Lotus, which have been under Chinese ownership for years.

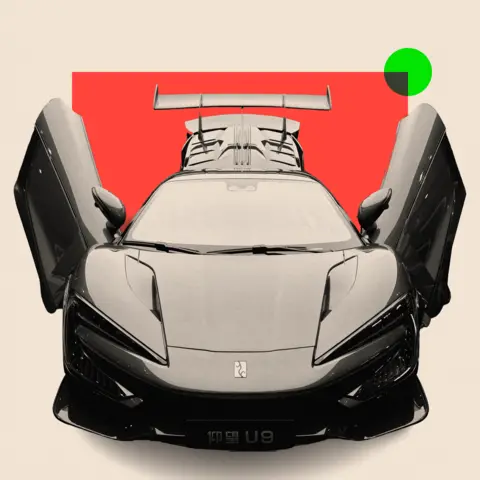

The products on offer already encompass a huge range, from runabouts like the tiny Dolphin Surf to exotic supercars, like the pothole-jumping U9, from BYD's high-end sub-brand Yangwang.

"Chinese brands are making massive inroads into the European market," says David Bailey, professor of business and economics at Birmingham Business School.

In 2024, 17 million battery and plug-in hybrid cars were sold worldwide, 11 million of those in China. Chinese brands, meanwhile, had 10% of global EV and plug-in hybrid sales outside their home country, according to the consultancy Rho Motion. That figure is only expected to grow.

For consumers, it should be good news – leading to more high-quality and affordable electric cars becoming available. But with rivalry between Beijing and western powers showing no sign of subsiding, some experts are concerned Chinese vehicles could represent a security risk from hackers and third parties. And for established players in Europe, it represents a formidable challenge to their historic dominance.

"[China has] a huge cost advantage through economies of scale and battery technology. European manufacturers have fallen well behind," warns Mr Bailey.

"Unless they wake up very quickly and catch up, they could be wiped out."

Cut-throat competition in China

China's car industry has been developing rapidly since the country joined the World Trade Organisation in 2001. But that process accelerated rapidly in 2015, when the Communist Party introduced its "Made in China 2025" initiative. The 10-year plan to make the country a leader in several high-tech industries, including EVs, attracted intense criticism from abroad, and particularly the US, amid claims of forced technology transfers and theft of intellectual property – all of which the Chinese government denies.

Fuelled by lavish state funding, the plan helped lay the groundwork for the breakneck growth of companies like BYD – originally a maker of batteries for mobile phones – and allowed the Chinese parent companies of MG and Volvo, SAIC and Geely, to become major players in the EV market.

"The general standard of Chinese cars is very, very high indeed," says Dan Caesar, chief executive of Electric Vehicles UK.

"China has learned extremely quickly how to manufacture cars."

Yet competition in China has become ever more cut-throat, with brands jostling for space in an increasingly saturated market. This has led them to hunt for sales elsewhere.

While Chinese firms have expanded into East Asia and South America, for years the European market proved a tough nut to crack – that is, until governments here decided to phase out the sale of new petrol and diesel models.

The transition to electric cars opened the door to new players.

"[Chinese brands] have seen an opportunity to get a bit of a foothold," says Oliver Lowe, UK product manager of Omoda and Jaecoo, two sub brands of the Chinese giant Chery.

STR via Getty

STR via Getty

BYD overtook Tesla in 2024 to become the world's biggest-selling EV manufacturer

Low labour costs in China, coupled with government subsidies and a very well-established supply chain, have given Chinese firms advantages, their rivals have claimed. A report from the Swiss bank UBS, published in late 2023, suggested that BYD alone was able to build cars 25% more cheaply than western competitors.

Chinese firms deny the playing field is uneven. Xpeng's vice chairman Brian Gu told the BBC at the Paris Motor Show in 2024 that his company is competitive "because we have fought tooth and nail through the most competitive market in the world".

'Naked protectionism' from the US?

Concerns that Chinese EV imports could flood international markets at the expense of established manufacturers reached fever pitch in 2024.

In the US, the Alliance for American Manufacturing warned they could prove to be an "extinction-level event" for the US industry, while the European Commission president Ursula von der Leyen suggested that "huge state subsidies" for Chinese firms were distorting the European market.

The Biden administration took dramatic action, raising import tariffs on Chinese-made EVs from 25% to 100%, effectively making it pointless to sell them in the US.

It was condemned by Beijing as "naked protectionism".

REUTERS/Leah Millis

REUTERS/Leah Millis

The Biden administration raised import tariffs on Chinese-made EVs to 100% in 2024

Meanwhile, in October 2024, the EU imposed extra tariffs of up to 35.3% on Chinese-made EVs. The UK, however, took no action.

Matthias Schmidt, founder of Schmidt Automotive Research, says the EU's tariffs have now made it harder for Chinese firms to gain market share.

"The door was wide open in 2024... but the Chinese failed to take their chance. With the tariffs in place, Chinese manufacturers are now unable to push their cost advantage onto European consumers."

Renault's ultra-modern EV hub

European manufacturers have been racing to develop their own affordable electric cars. French car-maker Renault is among them.

At its factory in Douai, in northeastern France, an army of spark-spitting robots weld sections of steel to form car bodies, while on the main assembly line, automated systems mate together bodyshells, doors, batteries, motors and other parts, before human workers apply the finishing touches.

The factory has been making cars for Renault since 1974, but four years ago, the ageing production lines were replaced with new highly automated, digitally-controlled systems.

Part of the site was also taken over by the Chinese-owned battery firm AESC, which built its own "gigafactory" next door.

Renault

Renault

This Renault plant is adopting production techniques used by some Chinese manufacturers

It's part of Renault's wider plan to set up an ultra-modern EV "hub" in northern France. Mirroring the lean production techniques of Chinese manufacturers, the hub cuts costs by maximising efficiency and ensuring that suppliers are located as close as possible.

"Our target was to be able to produce affordable electric cars here to sell in Europe," explains Pierre Andrieux, director of the Douai plant, arguing that automated processes "will enable us to do that profitably".

But the company is also exploiting something the Chinese brands do not have: heritage. Its latest model, the Renault 5 E-tech, built in Douai, borrows its name from one of the company's most famous products.

Getty Images and Renault

Getty Images and Renault

The original Renault 5 - which the new Renault 5 E-Tech emulates - became a cult classic

The original Renault 5, launched in 1972, was a quirky little everyman car with boxy looks and low running costs that became a cult classic.

The new design, despite being a state-of-the art EV, pays homage to its predecessor in name and appearance, in an effort to emulate its popular appeal.

Security, spyware and hacking concerns

But irrespective of how desirable Chinese cars are in comparison with European rivals, some experts believe we should be wary of them – for security reasons.

Most modern vehicles are internet-enabled in some way – to allow satellite navigation, for example – and drivers' phones are often connected to car systems. Pioneered by Tesla, so-called "over-the-air updates" can upgrade a car's software remotely.

This has all led to concerns, in some quarters, that cars could be hacked and used to harbour spyware, monitor individuals or even be immobilised at the touch of a keyboard.

Getty Images

Getty Images

Tesla pioneered "over-the-air updates" allowing software to be updated remotely

Earlier this year, a British newspaper reported that military and intelligence chiefs had been ordered not to discuss official business while riding in EVs; it was also alleged that cars with Chinese components had been banned from sensitive military sites.

Then in May, a former head of the intelligence service MI6 claimed that Chinese-made technology in a range of products, including cars, could be controlled and programmed remotely. Sir Richard Dearlove warned MPs that there was the potential to "immobilise London".

Beijing has always denied all accusations of espionage.

A spokesperson for the Chinese embassy in London says that the recent allegations are "entirely unfounded and absurd".

"China has consistently advocated the secure, open, and rules-based development of global supply chains," the spokesperson told the BBC. "Chinese enterprises operating around the world are required to comply with local laws and regulations.

"To date, there is no credible evidence to support the claim that Chinese EVs pose a security threat to the UK or any other country."

Chinese government is 'not hell-bent on surveillance'

Joseph Jarnecki, research fellow at defence and security think-tank The Royal United Services Institute, argues that potential risks can be mitigated.

"Chinese carmakers exist in this highly competitive market. While they're beholden to Chinese law and that may require compliance with national security agencies, none of them want to damage their ability to grow and to have international exports by being perceived as a security risk," he says.

"The Chinese government equally is conscious of the need for economic growth. They're not hell-bent on solely conducting surveillance."

But the car industry is just one area in which Chinese technology is becoming increasingly enmeshed in the UK economy. To achieve the government's climate objectives, for instance, "It will be necessary to use Chinese-supplied technology", adds Mr Jarnecki.

He believes that regulators of key industries should be given sufficient resources to monitor cyber security and advise companies using Chinese products of any potential issues.

As for electric cars powered by Chinese technology, there's no question that they're here to stay.

"Even if you have a car that's made in Germany or elsewhere, it probably contains quite a few Chinese components," says Dan Caesar.

"The reality is most of us have smartphones and things from China, from the US, from Korea, without really giving it a second thought. So I do think there's some fearmongering going on about what the Chinese are capable of.

"I think we have to face the reality that China is going to be a big part of the future."

Top image credit: Reuters

BBC InDepth is the new home on the website and app for the best analysis and expertise from our top journalists. Under a distinctive new brand, we’ll bring you fresh perspectives that challenge assumptions, and deep reporting on the biggest issues to help you make sense of a complex world. And we’ll be showcasing thought-provoking content from across BBC Sounds and iPlayer too. We’re starting small but thinking big, and we want to know what you think - you can send us your feedback by clicking on the button below.

English (US) ·

English (US) ·