Bitcoin Depot Chief Legal Officer, Chris Ryan, said that police departments using brute force to open Bitcoin ATMs and seize the cash inside is bordering on law enforcement overreach. Sawing them open might even be breaking banking and criminal laws, added Ryan. The executive told Decrypt that the money inside Bitcoin Depot ATMs rightfully belongs to the company, and that any damage to its machines will be held against the offending organization.

“You’ve got these rogue law enforcement officers thinking that they’re doing the right things by these consumers,” Ryan said. “What they’re actually doing is creating another victim, which is us, with the damage of our property and seizing of our funds.”

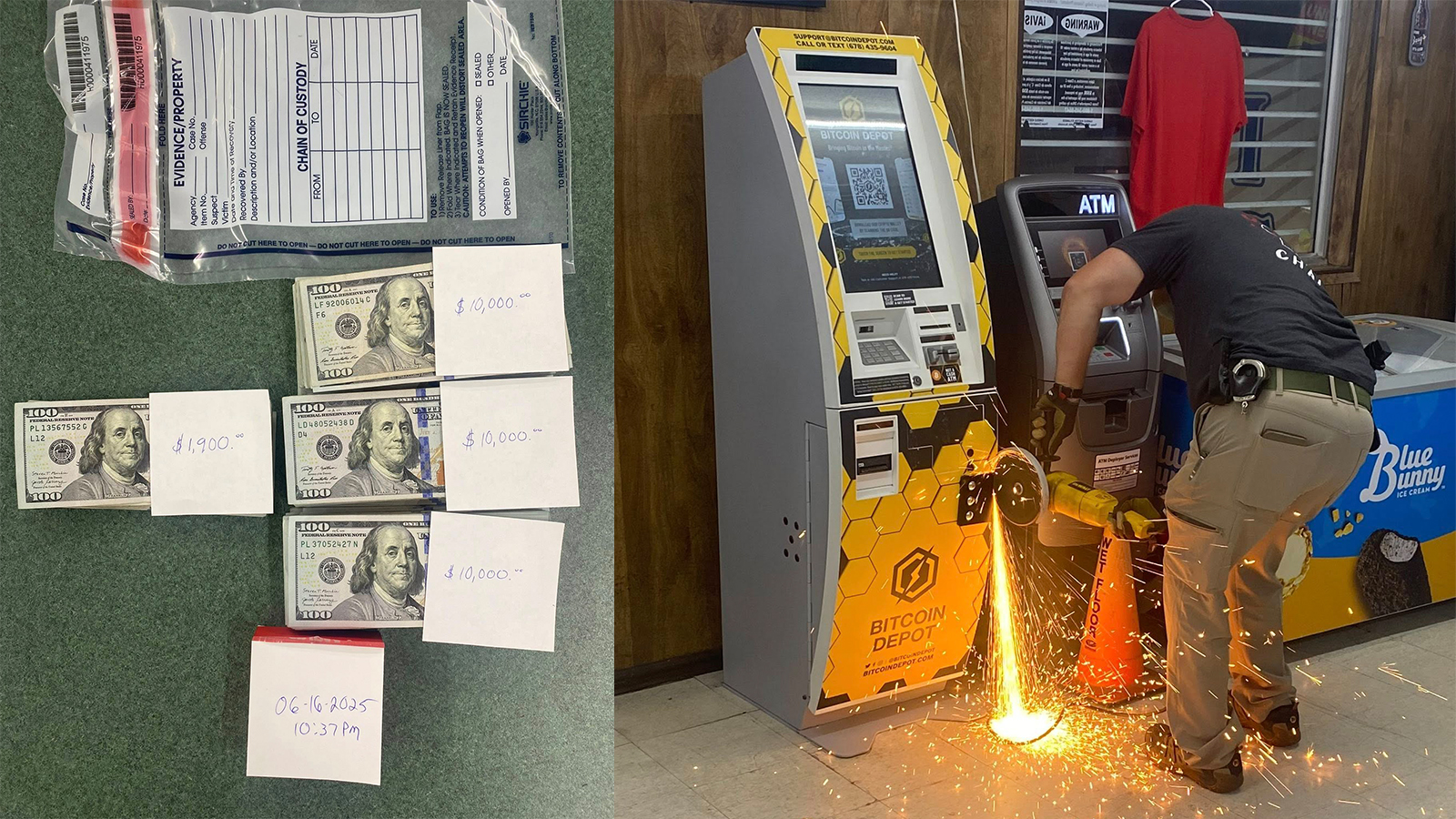

Just last week, the Jasper County Sheriff broke into a Bitcoin Depot ATM after one of its constituents reported getting scammed out of $25,000. Although the victim went through proper channels, and they were able to secure a search warrant, the money inside the ATM is legally no longer the property of the victim. Instead, the authorities should be going after the wallet address where the cryptocurrency was deposited.

Because the Sheriff used a power tool to break open the ATM to get its contents, Bitcoin Depot said that its machine — which cost $14,000 each — was completely totaled. This is particularly unfortunate because the company said that it always cooperates with law enforcement and will open the machine for them when going through the proper channels.

Requests like this happen up to 20 times a year, Ryan said to Decrypt, and that doesn’t even include cases where the police just straight up break their machines open. As for the latter, the company would charge the jurisdiction for the damage — something many can’t afford.

Crypto ATMs are similar to regular deposit machines, wherein they accept cash and credit the same amount to your bank account. But instead of going into your account, it would instead go into your nominated wallet address. Depositors that use the machine are required to confirm that they’re depositing the money into their own wallets, and it even warns users using third-party addresses that they might be getting scammed.

So, if someone was scammed out of their cash with a regular deposit machine, the police would not break the ATM — instead, they would coordinate with the courts and the bank to freeze the account and potentially get the money back. This should be the same pathway that victims should take when scammed through crypto. Unfortunately, many people, including law enforcement and the courts themselves, do not understand how crypto works. Because of that, we get incidents like these where police forcibly open crypto ATMs, causing damage to a third party's property.

While Bitcoin Depot and other similar operations are legitimate, they’re often used by scammers because of how fast and easy it is for them to get the stolen funds. Even though you can easily track crypto transactions due to the public nature of the ledger, getting them back is often difficult because of anonymity. Moreover, if the scammer does not use an exchange that works with the authorities, it’s difficult, often nearly impossible, to get the money back. Because of these attributes, scammers are increasingly switching from gift cards to Bitcoin ATMs.

Follow Tom's Hardware on Google News to get our up-to-date news, analysis, and reviews in your feeds. Make sure to click the Follow button.

English (US) ·

English (US) ·